TAX IMPACT

What a Local Operating Levy Means For Taxpayers

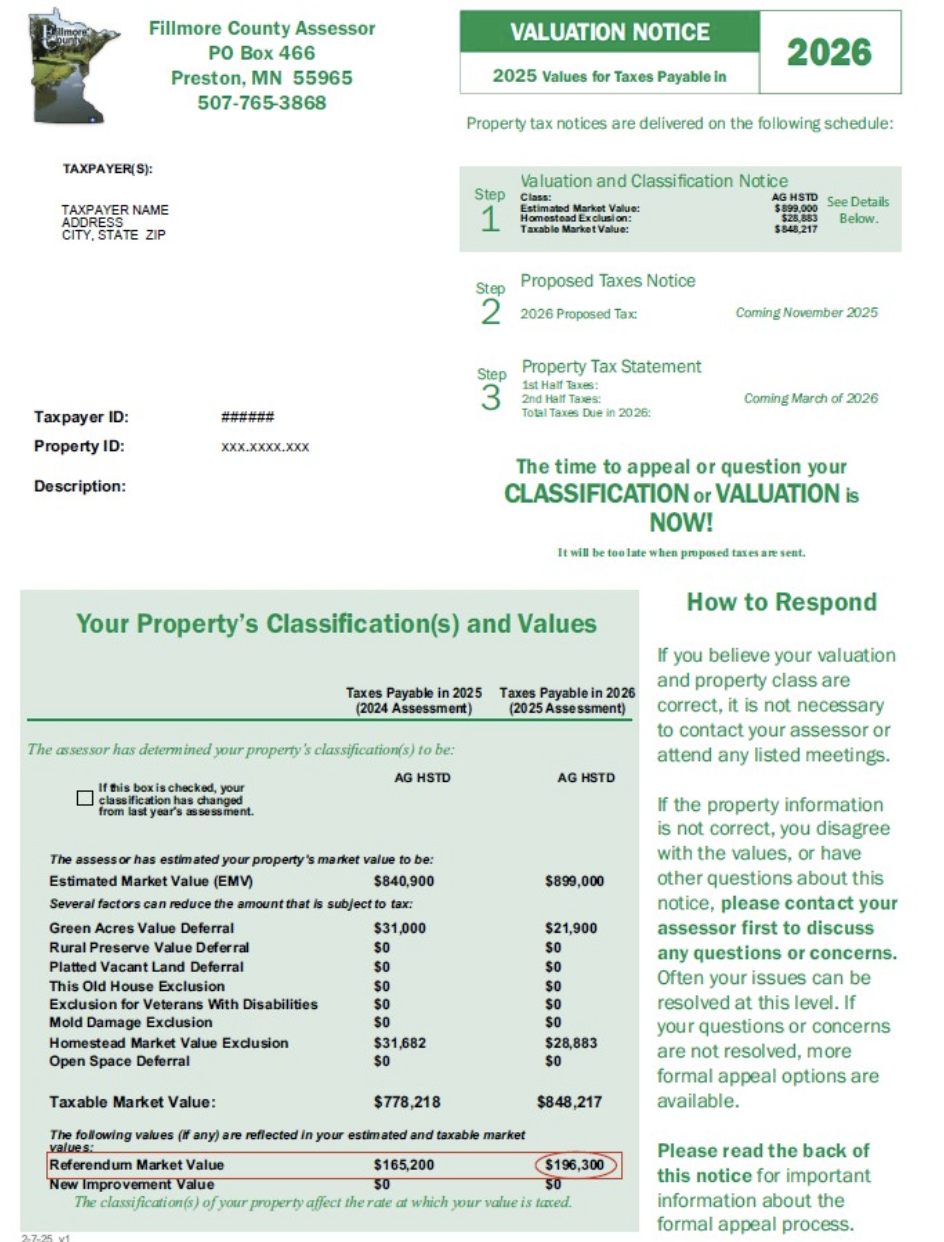

Grab your tax valuation notice from the assessor’s office, and use the calculator linked above to get an estimate of your individual tax impact. You’ll need to enter your Referendum Market Value, which you can find near the bottom of the notice.

I am familiar with my property’s Estimated Market Value, but the calculator is asking for my Referendum Market Value. What is the difference?

Your Estimated Market Value is the assessor’s valuation of your property, while the Referendum Market Value is a separate, more limited tax base used specifically for voter-approved levies, such as the proposed operating referendum.

Through an operating levy referendum, local residents can choose whether to approve a property tax that supports the day-to-day operations of their public schools.

Are all property classes taxed the same?

Tax Impact

Residential Homestead & Non-Homestead

Agricultural Homestead

but only on the value of your house, garage, and one(1) acre of land

Commercial/Industrial

Apartments (4+ units)

No.

NO Tax Impact

Agricultural Non-Homestead

Seasonal/Recreational (e.g. cabins)

If approved, what will it cost me?

This will be different for everyone.

The median value of a home in the district is $189,300. If the operating levy is approved, property taxes for this home would increase by approximately $198.33 per year. That’s $16.53 per month or $0.54 per day.

To see how your taxes could change, use the calculator linked above.